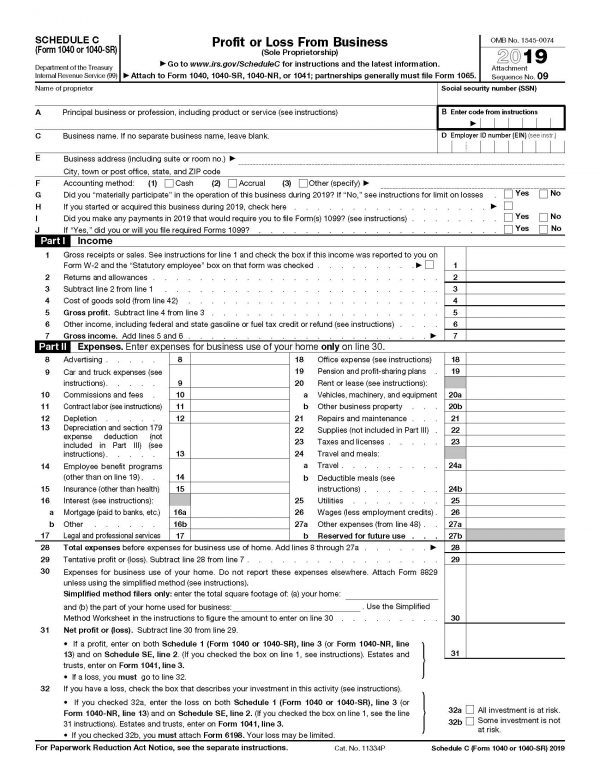

Schedule C-EZ - Net Profit from Business (Sole Proprietorship) Schedule C (Form 1040) is used to report income or loss from a business operated, or a profession practiced, as a sole proprietor.

Schedule C - Profit or Loss from Business (Sole Proprietorship) This schedule is used by filers to report interest and ordinary dividend income. Schedule B - Interest and Ordinary Dividends This schedule is used by filers to report itemized deductions. This form allows you to report income or loss from your business.īelow is a breakdown of all the schedules associated with Form 10-SR. While taxpayers typically file annually, if you are a small business owner, you may need to file an additional Schedule along with your Form 1040.įor sole proprietorships or LLCs where you are the sole owner, a Schedule C, for example, allows you to report your business income and expenses as an attachment to your personal income tax return. Of these schedules, Schedule C and Schedule C-EZ may be relevant to your small business tax filings.

There are several schedules for Form 1040. Whether you choose to fill out the form yourself through IRS Free File, use a tax software, or hire a professional tax preparer, there are several options for filing Form 1040. The IRS offers a downloadable version of Form 1040 that you can download and fill out, but if you are using a tax software program, there is likely an option to walk through the filing step by step. The form itself will require you to share personal data such as your Social Security Number, as well as tax calculations that include income, standard or itemized deductions, taxable income, and more. However, due to extended deadlines in 2020, this date is subject to change. While most taxpayers use Form 1040 to file taxes, this form is also relevant for small businesses with assets under $10 million. Here’s what you need to know: What is Form 1040?įorm 1040 is a two-page document used for annual income tax returns.

If you are a self-employed small business owner, a member of a partnership, a single-member LLC, or a small business owner who runs your company as a sole proprietor you may need to file a Form 1040. With so many forms to keep in mind, looking ahead to what you might need for your business’s annual tax filings can save a last-minute scramble. Taxes can be an overwhelming time of the year. If you have questions about Form 1040, please consult a professional. Nothing in this article constitutes tax or accounting advice. For specific advice applicable to your business, please contact a professional. This article is for educational purposes and does not constitute legal, financial, or tax advice.

0 kommentar(er)

0 kommentar(er)